doordash address for taxes phone number

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. Internal Revenue Service IRS and if required state tax departments.

A Complete Study Of Doordash Business Model Revenue

DoorDash Customer Service.

. The forms are filed with the US. A 1099-NEC form summarizes Dashers earnings as independent. Paper Copy through Mail.

DoorDash will send you tax form 1099. Is a corporation in San Francisco California. EIN for organizations is sometimes also.

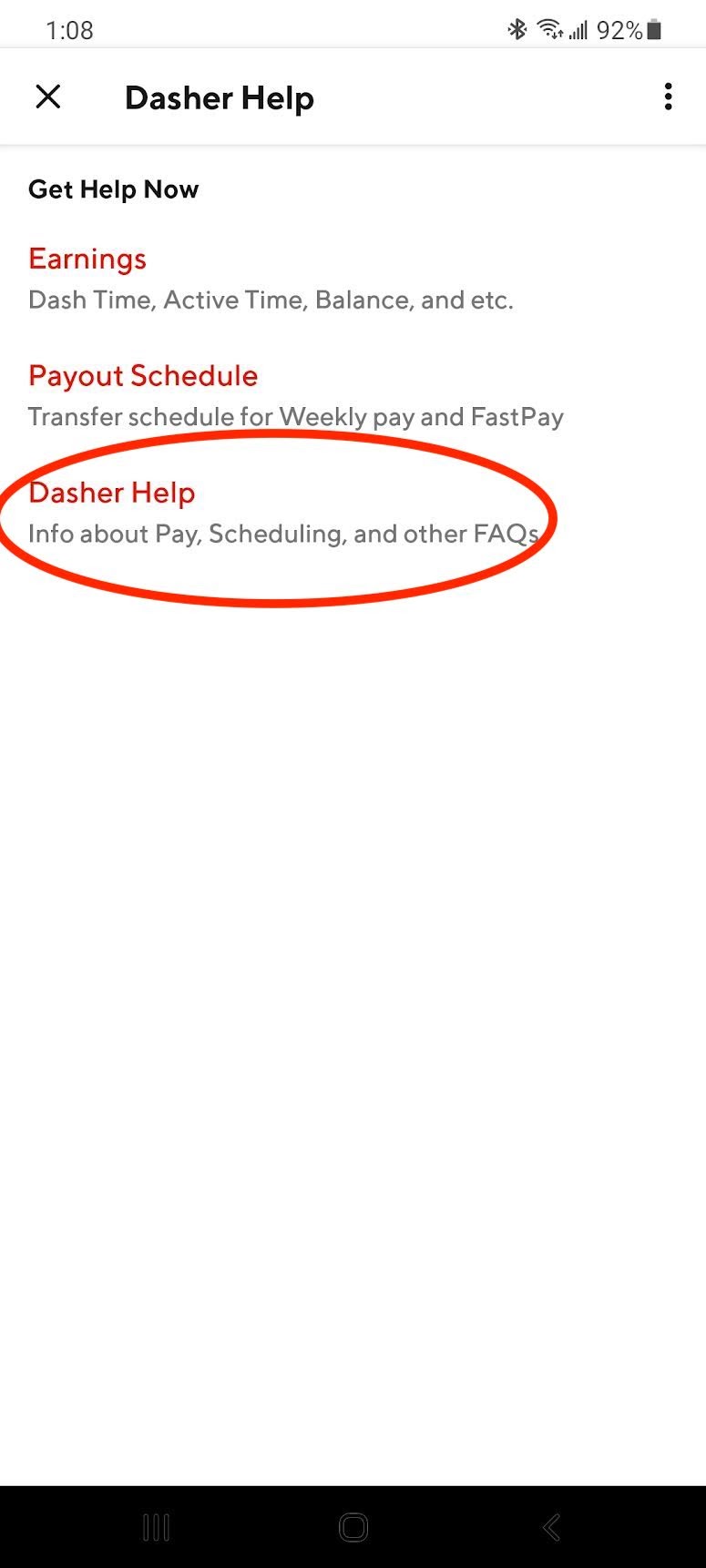

Since DoorDash earnings are treated essentially the same. While on the DoorDash support page you can choose to. Because DoorDash has offices all over the world they also have multiple support.

Doordash address for taxes phone number Tuesday March 15 2022 Edit. Breakfast lunch dinner and more delivered safely to your door. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

United States and Canada. DoorDash drivers are expected to file taxes each year like all independent contractors. It may take 2-3 weeks for your tax documents to arrive by.

However you may now be wondering what the process is for filing DoorDash taxes in 2022 to ensure you cover any tax liability. Up to 12 cash back Delivery takeout from the best local restaurants. You can also reach a.

If I wait longer than 10 minutes I typically send a quick note Still. Doordash address for taxes phone number Wednesday February 23 2022 Edit. Pin By Tasha On P Oc Creative Gen Chipotle Mexican Grill Mexican Grill Day Pin On Gig.

Now offering pickup no-contact delivery. Hi Im Dash your DoorDash driver. If youd like to speak to a merchant sales representative you can contact us online or call us Monday-Friday.

Here are some alternative ways to contact DoorDash customer service. One of the quickest and easiest ways to reach DoorDash is to call their toll-free customer service number. The employer identification number EIN for Doordash Inc.

Tax Forms to Use When Filing DoorDash Taxes. 901 Market Suite 600 San Francisco CA 94103.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22157871/1230032761.jpg)

Doordash Creates Chicago Fee In Response To City S Third Party Cap Eater Chicago

Do I Have To Report Doordash Earnings For Taxes If I Made Less Than 600 On Their Platform Quora

How Can I Update My Restaurant Address

Is Doordash Worth It Earnings Tax Deductions And More The Compounding Dollar

Amazon Flex Vs Doordash Best Job Guide 2022 Service Club

Doordash Dash Data Breach Exposed Some Personal Customer Data Bloomberg

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

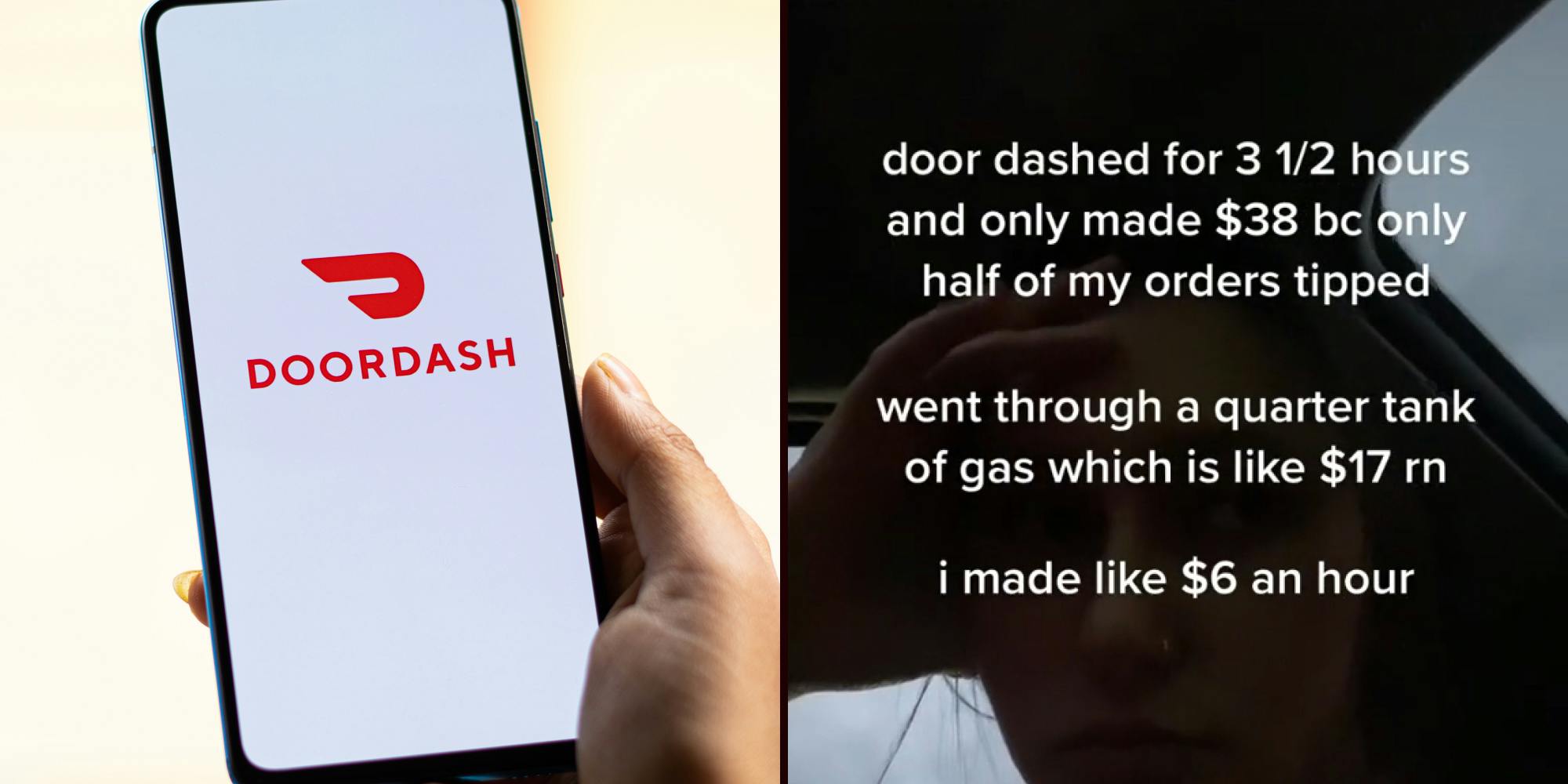

Doordash Tipping Guide What You Need To Know Before You Order Maid Sailors

Doordash Corporate Office Headquarters Corporate Office Headquarters

Chase Extended Its Doordash And Lyft Partnerships Here S How To Get Up To 10x Points And More Benefits Nextadvisor With Time

Class Action Claims Doordash Charged Sales Tax For Orders In Tax Free States

Form 1099 Nec For Nonemployee Compensation H R Block

Doordash Taxes And Doordash 1099 H R Block

How Do Food Delivery Couriers Pay Taxes Get It Back

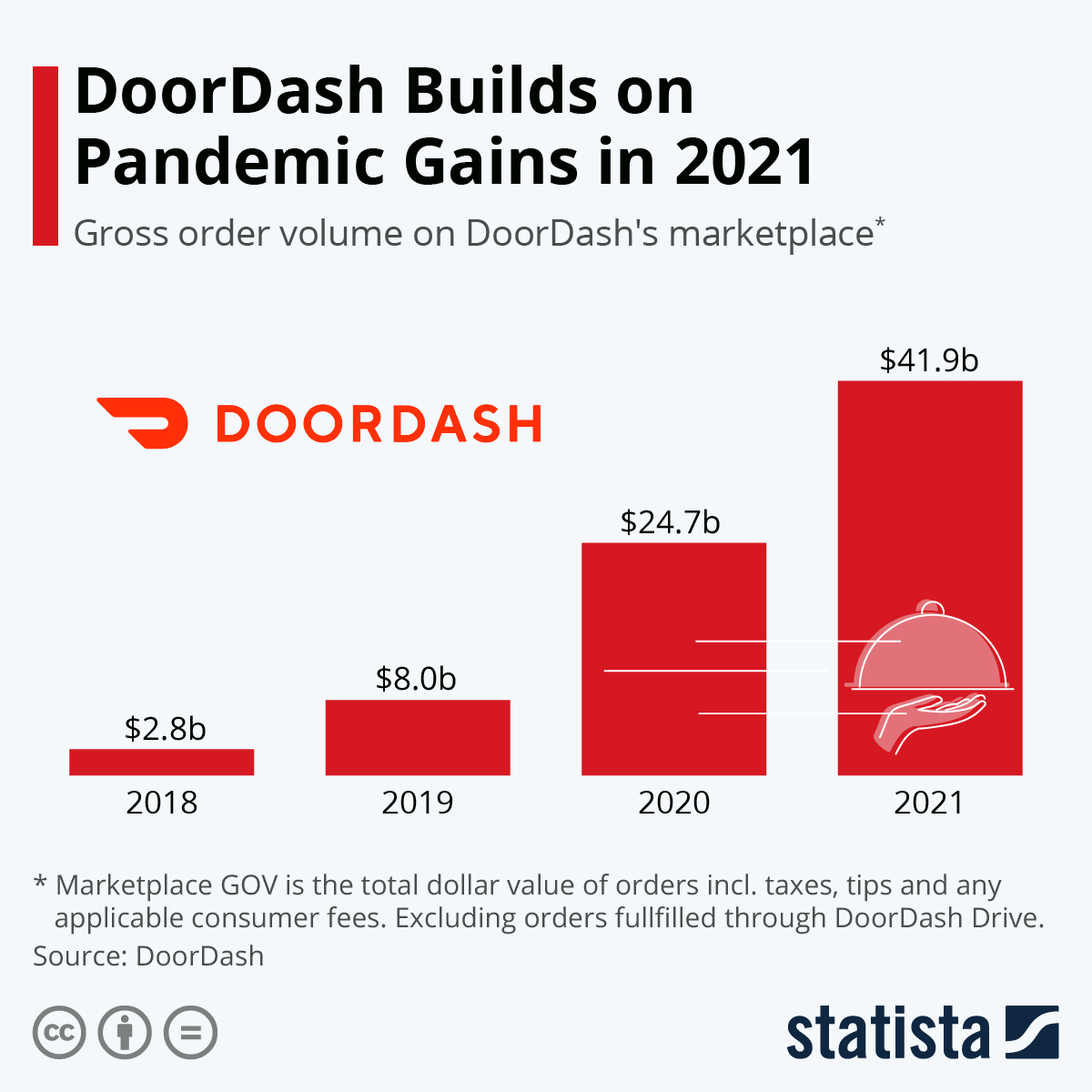

Chart Doordash Builds On Pandemic Gains In 2021 Statista

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier