prince william county real estate tax payments

As a resident of the Town you are required to. Payment by e-check is a free service.

The Sheriff Of Nottingham In Prince William County

EPortal eInspections ePermits ePlanStatus Land Plan Review.

. Press 1 to pay Personal Property Tax. You can pay a bill without logging in using this screen. Web How Does Prince William County Real Estate Tax Work.

Finding the Amount of Property Taxes Paid. Web Those who waited until the last minute to pay their personal property taxes in Prince William County encountered problems. Web Prince William County Tax Administration Division 1st FL 1 County Complex Court Woodbridge VA 22192-9201.

Manage Access - Grant Revoke. Tax Relief for the Elderly and Disabled. If payment is late.

Usually the taxes are collected. Awarded authority by the state district governmental entities manage property taxation. Office and Call Center hours are Monday through Friday from 8.

A convenience fee is. Web Quick Pay - No Sign In Required All you need is your tax account number and your checkbook or credit card. Web Most homeowners pay their real estate taxes through a mortgage services company.

Enter the Account Number listed. Web The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Web The eCheck system is Prince William County s no-cost automated payment system that allows you to pay real estate taxes personal property taxes and other taxes.

Prince William County is using a new on line system powered by NeoGov. When tax assessors estimate the value of your property they multiply that number by the tax rate of the. Access to Other Accounts.

Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date. Invoices are mailed beginning in November. Enter jurisdiction code 1036.

Web Welcome to Prince William Countys Taxpayer Portal. Median Property Taxes Mortgage 3893. Press 2 to pay Real Estate Tax.

Web Prince William County Property Tax Payments Annual Prince William County Virginia. By creating an account you will have access to balance and account information notifications etc. The system allows you to build resumes and submit multiple job applications to PWC on-line.

Web Dial 1-888-2PAY TAX 1-888-272-9829. Prince William County collects on average 09 of. Web PERSONAL PROPERTY TAX PAYMENT AND PENALTY.

Web What is different for each county and state is the property tax rate. At 930 pm the county announced its. Anyone who can browse the Internet can apply for jobs.

Web Find Payment Account. The County bills and collects tax payments directly from these companies. Web The total real estate tax amount is paid in one lump sum due February 15 of each year.

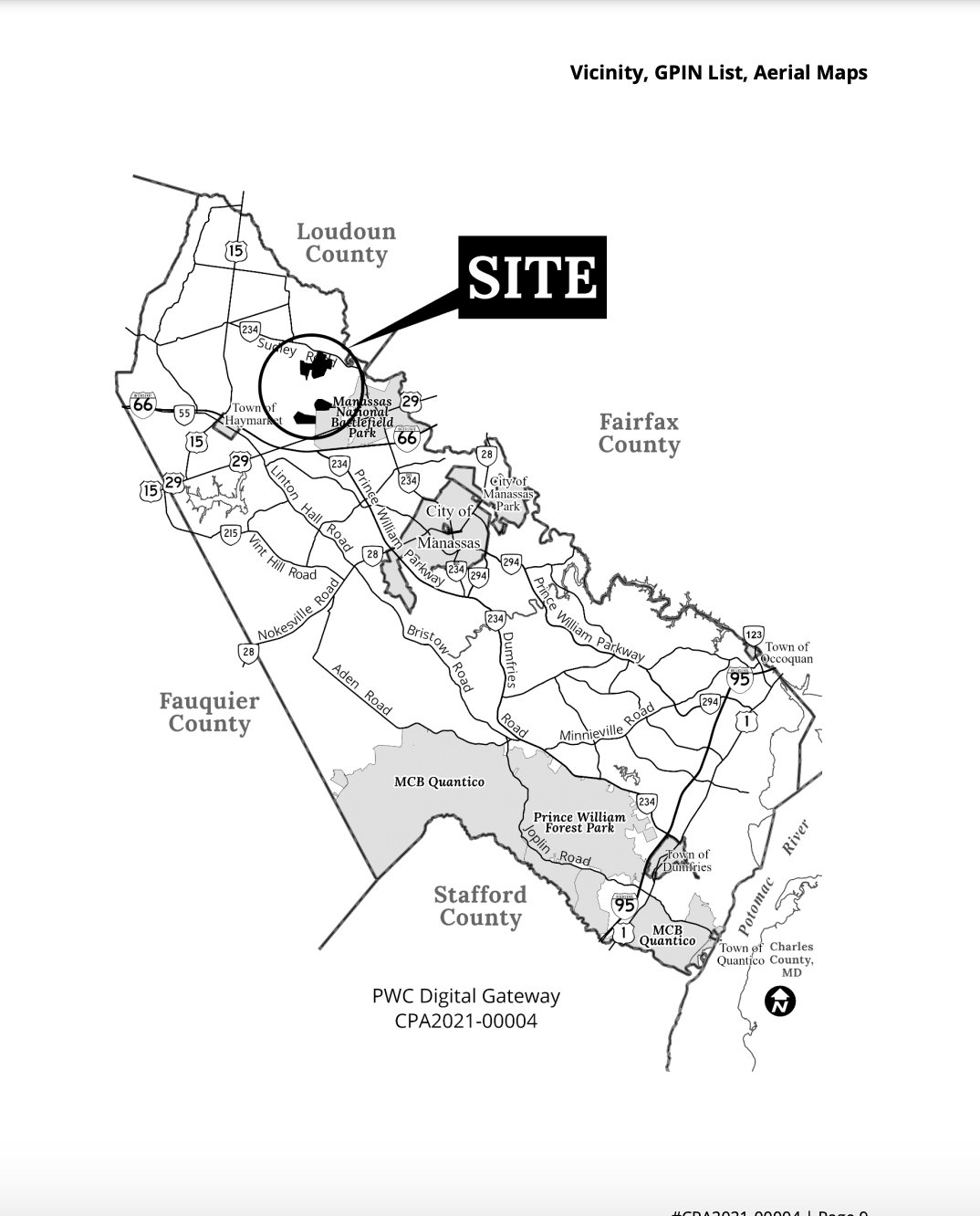

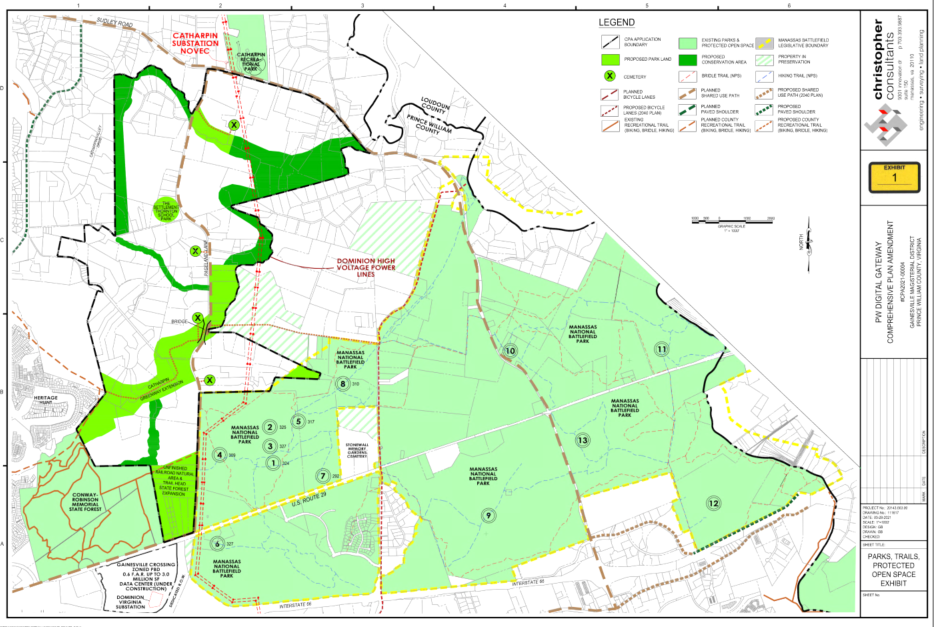

Prince William Could Steal Loudoun S Title Of Data Center Alley But Land Use Battles Are Raging Virginia Mercury

Prince William County Pledges New Protections For Old Cemeteries News Fauquier Com

Ntt To Develop 336 Mw Gainesville Virginia Data Center Campus Dgtl Infra

Prince William S Digital Gateway To Combine Tech Flex With Park Open Space Bristow Beat

Prince William County Va Businesses For Sale Bizbuysell

Northern Virginia Cools On Data Centers Is This An Opportunity For Us Cardinal News

The Coalition To Protect Prince William County Unless Someone Like You Cares A Whole Awful Lot Nothing Is Going To Get Better It S Not The Lorax

Prince William County To Formally Consider Data Centers Adjacent To Battlefield Bristow Beat

Prince William County Considers Land Use Changes That Encourage Sprawl The Piedmont Environmental Council

Prince William County Property Management Prince William County Property Managers Prince William County Va Property Management Companies

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

Less Taxes Less Spending Prince William Residents Decry Proposed Hike In Tax Bills Headlines Insidenova Com